Table of Contents

- 1 Why Do Merchants Need Amazon Seller Insurance?

- 2 What Are the Amazon Seller Insurance Requirements and Where to Find Them?

- 3 What is Amazon Product Liability Insurance?

- 4 What is General Liability Seller Insurance?

- 5 What is Amazon Seller Suspension Insurance?

- 6 What Type of Amazon Liability Insurance Do You Need?

- 7 Where to Get Amazon Product Insurance and How Much Does It Cost?

- 8 Final Thoughts: Protect Your Business with Amazon FBA Insurance

What’s the deal with the seller’s insurance? Do I need one? Does Amazon have insurance requirements? What insurance does Amazon offer?

What’s the deal with the seller’s insurance? Do I need one? Does Amazon have insurance requirements? What insurance does Amazon offer?

Lets’ start from the very beginning. If you’re an Amazon seller, you might have seen some dramatic alterations in the digital landscape for a few years. Online businesses have noticed significant changes in sales volumes since the beginning of the COVID-19 pandemic. It is because more buyers replace traditional brick-and-mortar stores with virtual platforms. Lockdown or not, it is a tendency that is likely to stay for a long time, as shoppers have embraced the convenience and speed of online shopping.

At the same time, there is a balance to keep. If something goes wrong and your company suffers, you might see your money drain away quicker than you can say, Jack Robinson. Most merchants don’t understand that Amazon.com requires users to obtain product liability police. The online giant isn’t accountable for the merchant’s mishaps. It is up to users to safeguard themselves from accidents, litigation, or injuries. Fortunately, marketplace e-commerce insurance isn’t as complex as it might seem.

With all the chants in Amazon Seller Central, you have to get Amazon seller liability insurance for your business. If you do not have one, it is high time to get started. This guide will help you understand different liability insurance options available for your business on Amazon.

Why Do Merchants Need Amazon Seller Insurance?

The requirement to register for an insurance certificate came as a surprise to Amazon business owners at the end of 2021. Business protection is the primary reason Amazon.com wants its merchants with professional seller subscriptions to get insurance. It helps to shield the company from any unpredicted scenarios.

First, treat your Amazon shop as a business. Technically it’s your virtual company, and as a company owner, a seller should do everything possible to protect it.

Registering for an Amazon FBA insurance program is the most convenient way to achieve that. Business liability insurance is perfect because its policy will safeguard your business assets and bear financial obligations that result from injuries, accidents, or litigations.

Suppose a client sues you due to some unforeseen issue while they were using one of your goods. An Amazon seller liability insurance certificate will shield you and your company from bodily injury, legal fees, property damage, and settlements.

Sure this, it’s the last thing that comes to your mind when running a business on Amazon. Nevertheless, mishaps do happen, and nowadays, people tend to submit lawsuits for any reason. The old saying goes: “It’s better to have it and not need it than to need it and not have it.”

Moreover, when your company operates as a partnership instead of a corporation or LLC when some customer sues you, they can deprive you of your assets. Therefore, we recommend setting up the Amazon business as a services LLC or corporation for extra protection.

What Are the Amazon Seller Insurance Requirements and Where to Find Them?

Amazon has experienced some product-related lawsuits lately. For that reason, the e-commerce giant enforced its Amazon seller insurance requirements for users. This move also provoked new alterations to the platform’s insurance policy to safeguard merchants and customers.

In the Seller Central account, it’s unclear where all the information on the Amazon business insurance guidelines is. However, in the Program Policy help section, Amazon.com lists the number of policies that sellers have to abide by.

You can also check Pro Merchant Insurance Requirements, where the online platform indicates the Amazon insurance requirements and criteria.

Recently, Amazon has made running a business with public and product liability insurance certificates a must-have for the merchants. Specifically, those making over $10,000 of sales within 30 days. Of course, if you make less than that, the marketplace won’t require you to operate with the insurance on your goods. However, as selling itself might be risky, we recommend buying it anyway.

While selling on Amazon, keep in mind these two things:

- Your selling insurance should be valid (i.e., it must cover the dates you’re trading and must have been purchased via trustworthy insurance providers).

- You should name Amazon.com as an additional insured on your policy.

So if you sell on Amazon in the United States or across several markets, you are covered when a client accuses your items of causing them damage, loss, or injury. When things escalate, and sparks begin to fly, you may bank on knowing that your insurance carrier will step in to handle the claim.

What is Amazon Product Liability Insurance?

Simply put, product retail insurance ensures financial protection for any claims of bodily injuries or property damage losses from an item sold, produced, or spread by your company. If your Amazon business plays an important part in the supply chain, for example, in manufacturing, distribution, or sales, — you should know the necessity for Amazon product liability insurance.

Why do you need it?

Clients usually get in touch with an item through sellers, making them the main targets in their product liability claims. Without Amazon product insurance, you might pay thousands of dollars for repairs, medical bills, or legal fees, all on your own. Besides, you might have to stop business or recall goods and risk hurting your reputation. A single claim might damage your standing, halt business operations, or even cause store closures.

Product liability insurance will guard your small businesses in case an item you sold or produced results in:

- illness;

- death;

- injury;

- property damage.

What is General Liability Seller Insurance?

General liability seller insurance is a basic policy to protect your company, whether a retail arbitrage or a private label merchant. This insurance covers property damage and injuries. It also safeguards you from judgments, settlements, and legal fees if someone sues you and this case goes to court.

Below are six main aspects included in the General Liability Insurance policy for Amazon sellers:

General aggregate limit

It is the maximum amount the e-commerce insurance that the provider will pay per insurance year for any claims emerging out of the seller’s advertising or personal injury, operations, fire damage, or medical payments. This limit for Amazon Sellers Insurance is $2M.

Products and completed operations limit

Such compensation safeguards sellers and manufacturers. For instance, when you sell lamps via the Amazon platform and a light bulb causes some damage to your customer, you might be sued since your items lead to harm. The limit for this coverage is also $2M.

Personal or advertising injury limit

It refers to libel, slander, interference with privacy, character defamation, fraudulent advertising practices, or cyber liability. Such coverage safeguards from lawsuits connected to any issues of the above. For instance, if a client publicly says something untrue about your company or your goods, this part of the insurance policy will get you covered. This limit is $1M.

Each occurrence limit

It’s the most that the insurance company will pay per claim resulting from your personal or advertising injury or operations per occurrence. The limit is $1M per case.

Fire Damage

It’s a separate limit that provides coverage in case of fire damage to buildings rented or leased by you. For instance, if a person accidentally leaves a teapot in their office and leads to a fire, this Amazon insurance coverage will cover the repairs. Such claims are taken from the General Aggregate Limit and are $300,000.

Medical Payments

This limit displays the insurance coverage for various medical payments to any third parties. Besides, it delivers unexpected medical expenses to others when they incur some injuries on your business premises. The carrier will ensure this limit regardless of the persons responsible for the exact damage. The medical expense limit for merchants is $5,000.

Why do you need it?

If you wish to smooth out any possible business risks that might come up in the future, be sure to get insurance. You will pay much less for the general liability cover than for the lawsuit.

What is Amazon Seller Suspension Insurance?

Amazon.com suspension insurance is a fairly new type of coverage for digital commerce sellers running their business on the platform. Amazon business insurance providers will cover all the monetary expenses if your account is suspended. Besides, it’s possible to bundle up this insurance with the general liability policy.

What Type of Amazon Liability Insurance Do You Need?

Sellers require $1 million per occurrence in liability coverage and, in aggregate, to meet Amazon’s seller’s insurance requirements for Professional merchants. The insurance protects the business and the Amazon platform itself from financial expenses if you’re accused of property damage or any related to your operations. Your policies should include goods, goods/complete operations, and bodily injury coverage. You might also satisfy the Amazon insurance limits by utilizing any combination of Umbrella, Excess Liability, or Commercial General Liability policy.

What insurance does Amazon offer? The platform’s new insurance guidelines state that the online giant will cover any customer claims under $1,000.

Anyway, companies face liabilities every day. So, sellers require general or commercial liability, first of all, to protect against common claims. Moreover, the proper insurance might ensure so-much-needed peace of mind, and you will be able to scale your business on Amazon without any fears. But how do you pick the right coverage?

While applying for your liability insurance certificate, let the carrier know everything about your company type and the nature of your products.

For instance, you are a private label Amazon seller with your goods produced overseas. You’re a manufacturer with affiliates and assignees as additionals insureds, so you will have great product liability. It might not be the same for a small retail arbitrage merchant.

Apart from your business model, the agent should consider the selling model, Amazon FBM or FBA. Thus, make sure you go to a person with enough experience in the Amazon marketplace cases.

Where to Get Amazon Product Insurance and How Much Does It Cost?

Merchants can choose any insurance company they desire, but their final pick must comply with the platform’s policies.

Applying to Umbrella, Excess Liability, or Commercial General Liability coverage is straightforward. Contact any insurance company such as Progressive, Wells Fargo, or Geico to get insurance quotes (Amazon-specific providers are below).

If you need product liability insurance for an Amazon business, your quote will depend on your average annual revenue. The estimated cost is nearly $1,000 for a year.

To easily check quotes from different insurance carriers, you can utilize Insureon. It will show you possible quotes from the best providers to compare. Don’t forget to inform your insurance agent beforehand that you are an Amazon merchant. It will ensure that your Amazon certificate of insurance will match all the platform’s requirements.

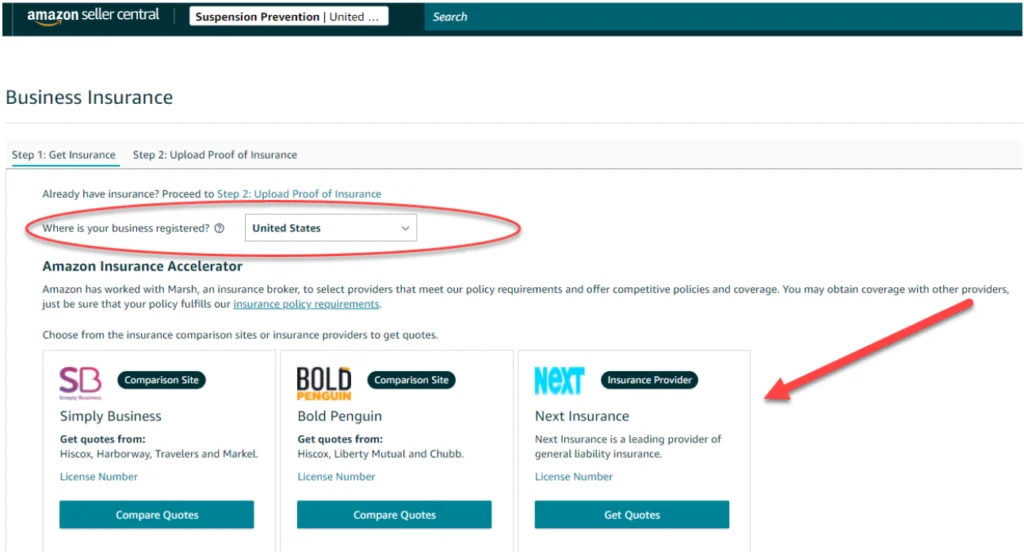

Amazon Insurance Accelerator

The platform has launched a new Amazon insurance accelerator to help sellers obtain insurance more easily and affordably. In addition, Amazon partnered with the Marsh provider to create a network of professional insurance companies so you can promptly get quotes and acquire insurance fast.

Insurance providers for Amazon merchants

Below are a few Amazon insurance services that work specifically with Amazon.com and e-commerce sellers:

- Next Insurance

- Well Insurance

- Bunker Insurance

What is excellent about applying to the insurance providers listed above is that they are aware of what kind of coverage you require as an Amazon merchant.

As soon as you get insurance, you need to upload the Amazon Certificate of Insurance to your Seller Central. Feel free to get the Amazon home insurance certificate from any Amazon insurance company you wish.

Besides, if you’re an international merchant selling in the United States, you can also get insurance. Reach the insurance providers that Amazon has added to its Insurance Accelerator. You can also apply to Marsh, a global Amazon insurance company that helps international sellers receive the necessary insurance.

Final Thoughts: Protect Your Business with Amazon FBA Insurance

Having an insurance seller certificate for your Amazon business is vital to protect your company and achieve success on the platform. Nowadays, the digital platform is developing and giving clients the option to sue anyone. Thus, you have to guard your brand. If you do not have Amazon liability insurance, it’s a good idea to get it. In turn, check out the policy on the website and consider the terms depending on your goods and product feasibility if you already have one.

Obtaining e-commerce business insurance for your Amazon company is not as complicated as you can think. Besides, it will shield you and your business with some much-needed protection. Thus, apply for small business insurance and have peace of mind to concentrate on growing your business!

In addition, SellerSonar can help you with Amazon listing monitoring to enhance conversions and boost sales. Check out how it works with our free 29-day trial!