Table of Contents

Making ends meet in your Amazon business is a must. Running every business implies a lot of costs. Therefore, if you don’t account for all your expenses, they may cause a snowball effect.

Making ends meet in your Amazon business is a must. Running every business implies a lot of costs. Therefore, if you don’t account for all your expenses, they may cause a snowball effect.

When selling on Amazon, remember that your business’s ultimate goal is, typically, making a net profit. This is why the majority of merchants start selling.

To be in the black figures, you should know your cost of sales. In your accountancy, a financial concept of Amazon’s Cost of goods sold helps you do so. A lot of sellers think of it as a headache. However, financials are an integral part of every business.

Not only does business COGS help you set the right price for your products since it’s an expense. It also shows the overall financial health of your business. In addition, it provides for effective tax management and indicates how much you can invest in growing your sales.

What does COGS stand for? How to calculate the cost of sales on Amazon? Read further to get to know it!

What Is the Cost of Goods Sold?

Cost of goods sold is an accounting term that indicates the expenses for manufacturing and selling a product. To clarify, it’s costs related to selling your products on Amazon.

For instance, if you are a retail or online arbitrage seller, the Cost of goods sold will include wholesale prices you’ve paid for inventory. In addition, transportation fees and other relevant expenses until you receive the product are also COGS.

Amazon Costs of goods sold is an expense. It is an accounting principle that helps match the cost of an ASIN and its sale. It shows your revenue and profitability in a specific month.

In the sale price of a product, it is the major part of the money you spend on it. Roughly, the rest is your profit margin. Because the Cost of goods sold is deducted from the sale price, the higher the Costs of goods sold, the lower the profit margin.

Therefore, knowing Amazon’s cost of goods sold helps you better manage inventory. You can see what’s profitable and what’s not.

COGS Amazon example

Here is a simple COGS example. For instance, a private label merchant purchases 150 pullovers from an Alibaba manufacturer in China. They spend $15 per unit (including shipping, import fees, and other costs of bringing the products into the U.S.).

The total investment before you list pullovers is $2,250 before profit.

The $15 you’ve paid per unit (not including marketing, salary, and similar costs) refers to Costs of goods sold.

Amazon requires FBA sellers to list products with a sale price of at least 10% higher than their COGS.

Note: The value of this indicator may vary depending on the accounting method you apply.

What Does Cost of Goods Sold Include?

Basically, COGS comprises the costs related to the ASIN’s production and does not include overhead costs. Costs of goods sold expense includes direct and indirect costs.

Direct costs

The direct costs are expenses for inventory manufacturing.

Direct costs

- procurement;

- production/acquiring;

- packaging;

- labor;

- material.

Indirect costs

These are the expenses necessary to sell your products.

Indirect costs

- fulfillment fees, storage fees, and taxes and duties.

- storage fees and costs;

- shipping costs;

- taxes and duties;

- listing fees.

Note: COGS doesn’t include certain operating expenses (OPEX). These are utilities, payroll, office rent, and accounting fees.

Knowing cost of sale matters

Why Is COGS Important?

Since Costs of goods sold is an expense, it helps you monitor your revenues, gross margins, and profitability in a given month. Accounting for the cost of goods sold gives more accurate control over the inventory. It is used to recognize the most profitable products, develop a competitive pricing strategy, and control inventory costs.

Figuring out the most profitable ASINs

Costs of goods sold is the component of your sale price. Therefore, the higher the COGS, the lower the profit. By tracking the Cost of goods sold, you can pick out the most profitable items and adjust your marketing campaigns to advertise these ASINs. On the other hand, you should look into your strategies with the items that bring low profit.

Developing a competitive pricing strategy

As far as COGS is the cost of doing business, this metric helps sellers estimate their bottom line. If it is high, net income is low, and the business will generate less profit.

You can adjust your price compared to the competition without making red figures. At the same time, you’ll ensure that you cover your expenses.

Controlling inventory costs

COGS helps you be savvy about your inventory. It’s important to keep your Costs of goods sold low to generate a higher profit. Also, it helps determine inventory expenses for tax reporting. You should see what you address as COGS since it lowers your taxes.

What Is COGS In Accounting?

Generally, accountants calculate COGS by the formula.

Formula for accounting

COGS formula

Example

A seller purchased inventory for $20,000 at the beginning of the year and an additional inventory of $10,000 3 months later. At the end of the year, the leftover inventory is $3,000.

Your Costs of goods sold is, therefore = $20,000 + $10,000 – $3,000 = $27,000

If you produce your inventory, the U.S. Internal Revenue Service (IRS) recommends you apply the formula below.

COGS = (Inventory at the beginning of the year + net purchases + cost of labor + materials and supplies + other costs) – inventory at the end of the year

The Two Accounting Methods of Calculating COGS

In accounting, there are two ways of calculating the Cost of goods sold – cash basis accounting and accrual accounting.

Cash basis accounting

This method is the simplest way to account for revenues and expenses. It recognizes the inventory the moment you purchase or receive it.

For instance, if you’ve paid the supplier $10,000 for 1000 T-shirts, you recognize the expense immediately.

The majority of the sellers use this method due to its simplicity. However, it’s not very accurate when accounting for profits.

Accrual accounting

With this method, you recognize payments and expenses when a transaction happens rather than when you receive payment. To clarify, you should recognize expenses and revenues in the same reporting period.

In practice, that means your account for your orders as an inventory asset and expenses the units when you sell them.

For instance, you purchased 1000 T-shirts in March, but they started selling in May. In such a case, your account for the money you paid for the inventory as an expense in May.

Some sellers use this method since it accounts for the revenues more accurately.

Inventory Valuation Methods

The value of COGS depends on the inventory costing method you apply. There are three methods to account for the inventory you sell over a period: First In, First Out (FIFO), Last In, First Out (LIFO), and the Average Cost Method.

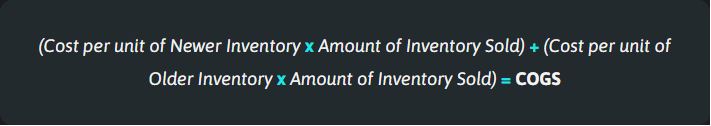

First-In, First-Out (FIFO)

With this method, you assume the oldest units of inventory are always sold first.

To figure out COGS using FIFO, you should get the cost per unit of your oldest inventory and multiply that cost by the number of inventory sold.

COGS formula using FIFO

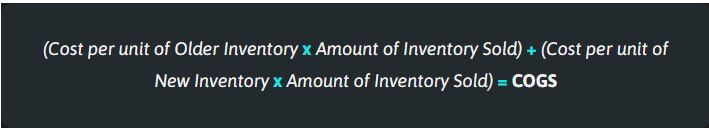

Last-In, First-Out (LIFO)

This is the opposite approach. You assume that you sell the newest inventory before the oldest.

To determine COGS using LIFO, you should take the cost of your most recent inventory and multiply that by the number of inventory sold.

COGS formula using LIFO

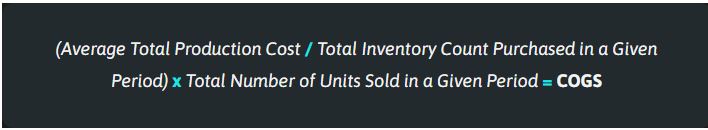

Average Cost Method

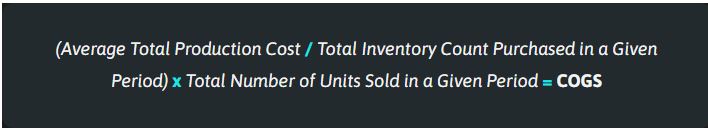

Here, you use the average price of all the stock goods, regardless of purchase date, to value the goods sold.

You should use this method to compute the average cost of each product you purchased over a particular period. Then apply that figure to calculate the Cost of goods sold by formula.

Average cost formula for COGS

Learnings from COGS (Cost of Goods Sold)

To get more satisfied with your business’s numbers, look at your company in the following ways to better understand your COGS.

- COGS is a significant contributor to margins: Your firm will never make money if this indicator is higher than your merchandise pricing. Always monitor COGS to help guarantee you generate an operating profit.

- Gain a fine-tuned understanding of COGS: Do not just look at the high-level Costs of goods sold performance. Look at each underlying cost for savings options.

- Strategically lower cost of goods sold: Even little progress on COGS results in higher profits. For low-margin companies like retailers, a minor difference in Costs of goods sold can make or break the business.

- Keep a long-term priority: Avoid making cuts that harm your client experience, product quality, or staff experience, as they could turn around and harm your long-term view.

You do not need a substantial financial background to use COGS to develop a more profitable long-term brand strategy. Any seller can use Costs of goods sold to enhance their business.

Final Thoughts

Making black figures is important. It shows how healthy your Amazon business is. To understand your expenses and revenues better, you should know your cost of sales. For that, in accountancy, there is a financial concept of Amazon Сost of goods sold. It helps you to develop the right price strategy, control your inventory costs, and grow your business without overspending.

Alongside tracking your profitability, you shouldn’t forget about your product performance. Amazon monitoring software is an efficient way to stay on top of your sales. SellerSonar offers instant Amazon alerts to protect your sales. With us, you are aware of all listing changes, Buy Box hijackers, new/deleted reviews, keyword rank history, and product suppressions.

Try SellerSonar now. Register for our 90-day trial and boost your incredible journey of running your business on the platform.